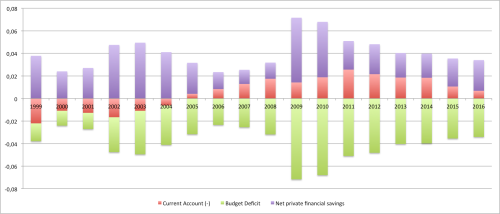

This afternoon I devoted to the sectoral balances of the eurozone. The current account is inverted, the public deficit a deficit and the private sector financial surplus a surplus. Some of the recent data is probably a forecast. I let the data speak for itself for now. Just one comment: the only country not able to run a consistent and significant surplus in the private sector is Greece. This is situation is hardly sustainable as debts are more easily repaid when a surplus exists. Continuation of the debt structure into the future is hence possible, but not likely.

Here the sectoral balances (in % of GDP; data from AMECO, more details below):

Germany

Ireland

France

Italy

Spain

Greece

Details about the AMECO data

The following are the data series that I used to compile I, G, T, EX and IM. S_p is retrieved through calculation S_p = I + G – T + EX – IM. (There is no reliable data for S_p.)

- 3 – CAPITAL FORMATION AND SAVING, TOTAL ECONOMY AND SECTORS

There might be another, more direct, possibility, to get to the sectoral accounts, using exports and imports from above and then net financial saving of government, corporate and household sector:

Net lending (+) or net borrowing (-) (B9) (UBLC)

15 – HOUSEHOLDS AND NPISH (S14 + S15)

Net lending (+) or net borrowing (-) (B9) (UBLH)

Thank you!

It would be helpful if you divide the private sector in Households, Non-financial Corporations and Financial Corporations.

If you do this, you will see the situation in Greece is a lot more awful.

The private Households are in dept all over the time since 1996!

How this works? I dont understand it.

By: christophgstein on July 14, 2016

at 4:14 pm

Households can shoulder a balance sheets where liabilities are higher than assets. (Firms can’t.)

By: Dirk on July 14, 2016

at 7:43 pm

OK, so you think its normal that corporation run a surplus and housholds are in dept?

What about this chart of the sectoral balances of Germany 1960-1975 (from flassbeck)?

Here the corporation are in dept all the time and it worked.

By: christophgstein on July 14, 2016

at 8:12 pm

I did not write that it is normal that corporations run a surplus and households are in debt. I wrote that it is possible, whereas the opposite would not. Pointing out some time period and saying that “it worked” is not convincing to me, sorry. The last years, the German economy did relatively well – compared to its neighbor economies – and firms had big surpluses. Still I would not say that this is a preferred macroeconomic regime (and I think you agree with me).

By: Dirk on July 14, 2016

at 8:15 pm

>I wrote that it is possible, whereas the opposite would not.<

So the "opposite" (which is not possible) is the situation, that corporations are in dept and the households are in surplus.

This is exact the situation in Germany 1960 – 1975, so this situation "is not possible"?

Sorry I dont understand, bc this situation was one of the best times Germany had ever.

For me this situation, where companies are in dept, households are in surplus, the current account and the budged are balanced is the most preferred macroeconomic regime, this is why I chose it.

By: christophgstein on July 14, 2016

at 8:39 pm

My mistake, of course it is possible for firms to run net _financial_ deficits. There problem is: this usually ends badly. Minsky was a great economist who saw this clearly, taking a birds eye view. In my view, government deficits are necessary for economic development. The current account should be balanced over the long term, but depending on the situation of profits and transfers and so on even this is up for discussion.

By: Dirk on July 14, 2016

at 8:44 pm

>Its ends badly< We see this in the chart. 1965/66 got a crisis and the firms tried to reach the surplus, the same 1973. At both points the budged went downside. Both crises where short (the real probleme came with oilprice and inflation) So maybe Minsky is right, but I am not really convinced.

But this means there has to be a permanet money-input from goverment and centralbank to keep the economie running. (I have no problem with this, I try to understand how to manage a most preferred macroeconomic regime)

"current account" I think it is dangerous to be in dept in a foreigt currency. You have no controll over it, if you are not the USA.

By: christophgstein on July 14, 2016

at 9:05 pm

[…] 1 Ikus https://econoblog101.wordpress.com/2016/07/14/sectoral-balances-of-the-eurozone/. […]

By: Euroguneko sektore-balantzeak | Heterodoxia, diru teoria modernoa eta finantza ingeniaritza on July 15, 2016

at 9:20 am

Could you specify the exact data that you have used and where exactly to find it in AMECO statistics? I’m familiar with their statistics but I don’t know what exactly I have to use to elaborate the sectoral balances. Thank you very much!

By: Student101 on September 5, 2016

at 9:08 am

I used total export and total imports for the current account, then government spending and total taxes for the government budget deficit, and then the private sector balance is already fixed because private sector balance + current account + government deficit = 0.

By: Dirk on September 5, 2016

at 9:14 am

Thank you very much. And is there any way to doble check the private sector balance? I know that the identity always works, because it is an identity… but just for curiosity.

By: Student101 on September 6, 2016

at 11:16 am

As far as I know it can be done by going through the balance of payments, but usually it doesn’t work. It seems that some capital flows leave no paper trail, and this means that those statistics are not so reliable. Those of external trade and government account usually are precise, and (physical) investment should be precise, too, which means that Sp is usually arrived at through mathematics using the identity rather than getting it from empirical fact.

By: Dirk on September 6, 2016

at 11:37 am

And how could the private sector be split into households and corporations? Many thanks for your answers?

By: Student101 on September 22, 2016

at 11:08 am

[…] 3 Ikus https://econoblog101.wordpress.com/2016/07/14/sectoral-balances-of-the-eurozone/. […]

By: Merkataritza: sektore balantzeak | Heterodoxia, diru teoria modernoa eta finantza ingeniaritza on January 10, 2017

at 10:14 am

[…] Sectoral balances in Europe: https://econoblog101.wordpress.com/2016/07/14/sectoral-balances-of-the-eurozone/ […]

By: Amagi Podcast @ Think Liberty – Episode03 – Sectoral Balances & Eurozone Madness! | EconomicsJunkie on April 21, 2020

at 2:28 am