Martin Wolf had an article in the FT yesterday about the German growth model being applied to the whole euro zone. He notes that because of the flawed analysis that ‘government debt did it’ there is only one way left for demand to grow:

That leaves external adjustment. According to the IMF, France will be the only large eurozone member country to run a current account deficit this year. It forecasts that, by 2018, every current eurozone member, except Finland, will be a net capital exporter. The eurozone as a whole is forecast to run a current account surplus of 2.5 per cent of GDP. Such reliance on balancing via external demand is what one would expect of a Germanic eurozone.

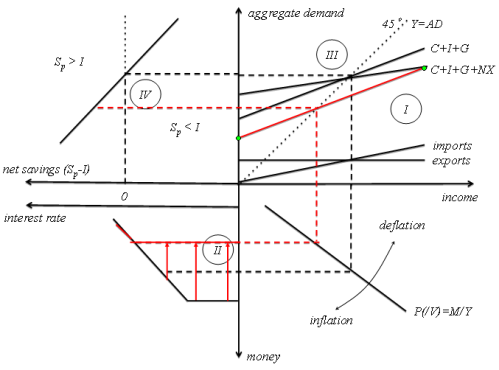

Yesterday I had shown the situation in crisis countries applying my own IS/MY model. So, this is where we are (red lines):

Investment has fallen, debt is being repaid (IV), demand is weak and supply is down (III) with expectations of more of the same (I). Monetary policy is useless since we are in the liquidity trap (I). How do we get out?

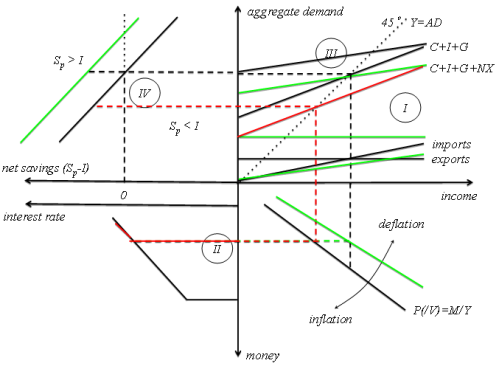

My suggestion was to use government spending to increase demand towards levels that bring us closer to full employment. However, the political leadership does not allow it. Instead, the plan is to increase exports in all euro zone countries which would bring the whole euro zone into a net exporting position, as described by Martin Wolf above. Here is what the result would look like (green lines):

So, becoming more competitive means that prices are falling relative to prices elsewhere, which I show as a change in the level of inflation in the south-east quadrant. This pushes domestic incomes down and will lead to lower domestic consumption. This causes imports to fall since these are now relatively more expensive. What is produced and not absorbed by domestic sources is exported, which means that exports will be rising. Total demand is back where it was before, since the fall in domestic demand has been compensated by a rise in foreign demand.

Foreign demand, however, can only increase if foreign incomes are increasing, which partly consist of foreign lending. So, if euro zone countries lend abroad, then this kind of economic adjustment will work in the short run. Of course, it will create foreign debt with the trade partners. These, however, are not part of the euro zone and in part of default after the next real estate bubble can default on their debt obligations and devalue their exchange rate.

An alternative path which might be complementary is a real estate bubble in Germany. The first signs are already visible, and the authorities do not seem willing to reign in the free market. If this is the European strategy, it is creating unsustainable debt bubbles elsewhere while keeping adjustment in Germany at zero. It will be interesting to see whether the trade partners of the euro zone are willing to turn into net importers. If not, there might be a beggar-thy-neighbor policy race, these days called “currency war” by a press which is happy for every war (war on drugs, war on terror, and so on). Basically, declaring a war lets you free ride as in an actual war in the sense that critical voices will be blended out and dissent shouted down. The Iraq war sets the precedent.

So, where does it leave the world? Will perhaps China be turning into a net importer vis-a-vis the euro zone? Will it be Eastern Europe? The US quite certainly won’t have it, since they just had a real estate bubble. Politically, we are back in mercantilist times where nations compete for markets and international cooperation takes a back seat. In order to become competitive, you could either increase productivity or cut wages. Obviously, since government spending is cut, the euro zone opts for the second alternative. This means that purchasing power of households who depend on income from wages (and not interest from invested capital) will fall. Instead, a bigger part of production will be exported in exchange for foreign assets that might be defaulted upon by those that emitted them (think of Iceland). In how far that is to promote peace and prosperity in the European Union or elsewhere I have no idea.

Leave a comment