Bonds have done well in the crisis so far as they are deemed to be a safe haven. When bond prices are bid up the effective yield falls. A short example. A nominal $100 dollar one year bond that pays an interest rate of 5% will deliver a return of 5% if the bond is traded at $100. It will pay $100 principal plus $5 interest after one year. The interest is fixed on the bond itself and cannot change. However, its price can change. If bonds are in demand, the price might move up to $101. It still pays out $105, so the effective yield is (bond price nominal – bond price market + interest)/bond price market which equals $105/$101, more or less 4%. If demand for bonds is really high, then bond prices will be going up to the point where the bond price on the market is equal to the nominal bond price plus the interest. If it goes up further, investors lose money. Under some circumstances, this is possible, but nevertheless there is a soft roof which the bond price will not be able to pass because investors lose money. Holding money would make them better off.

Now, every now and then there is a situation when the economy stagnates and bonds are very much in demand. At some point, basically with interest rates at zero, bond prices can only go down because interest rates can only go up. Some people think that this is a very bad thing, like the discussion in this NY Times article shows:

A number of big-name investors say they believe that the low rates and economic uncertainty are likely to endure, giving bonds a continuing attraction. William H. Gross, the co-founder of Pimco, and perhaps the world’s most famous bond investor, said on Twitter that he expected interest rates would fall further in 2013, in part because of continuing growing pains in the American economy.

Mr. Gross’s prediction is particularly notable because in 2011 he bet that interest rates would rise, leading him to sell off some of his firm’s Treasury bond holdings. When that bet lost money, Mr. Gross reversed course.

Many people have been wrong in the crisis, and if Gross would not have changed his mind he wouldn’t be in his old position, I suppose. I criticized him for his invoking the confidence fairy some months ago, but losing money is a better reality check then some logical arguments for most financial market participants. Anyway, the NY Times article has a very nice ending:

Tad Rivelle, the head of bond investing at TCW, said that the Federal Reserve’s current policy was most likely to fail and kill confidence in Treasury bonds, forcing the government to pay higher interest rates to borrow. But even if the Fed succeeds, Mr. Rivelle said, interest rates will end up in the same place.

“Whether Fed policy succeeds or fails, rates are ultimately going to be going significantly higher,” said Mr. Rivelle.

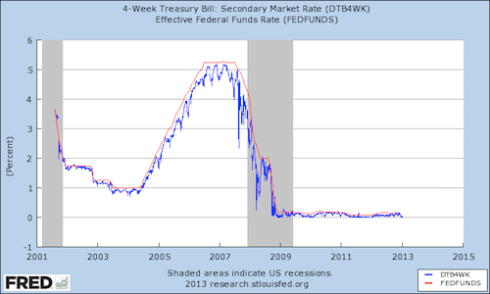

This is what Keynes meant when he said that in the long run we are all dead. If the US turns out to be like Japan, then Mr Rivelle’s tautology will not come true for some 20+ years. Richard Koo pointed out that foreign investors attacked Japanese bonds many times, and they always lost. If the central bank provides very cheap credit at the zero lower bound, then sovereign bonds arbitrage is a no-brainer. You borrow at zero, you get a return of more than zero from a risk-less asset. Here is the picture for the US:

Mr Rivelle doesn’t seem to get that. ‘Whether Fed policy succeeds or fails …’? The Fed sets the interest rate and by that fixes the short-term bond price, too. The yield curve builds on this short-term interest rate. If the Fed says it is zero, then so it is. It can keep it there forever and will only move it if it feels like it (core inflation coming up). Low interest rates cement bond prices on the high plateau that Irving Fisher saw for stock prices in 1929. However, arbitrage does not work with the stock market since the asset carry risk. Sovereign bonds do not. Only political meddling can cause governments to default on debt when they are not forced to, as this text at the EPI coalition explains:

An extreme example is Russia in August 1998. The ruble was convertible into $US at the Russian Central Bank at the rate of 6.45 rubles per $US. The Russian government, desirous of maintaining this fixed exchange rate policy, was limited in its WILLINGNESS to pay by its holdings of $US reserves, since even at very high interest rates holders of rubles desired to exchange them for $US at the Russian Central Bank. Facing declining $US reserves, and unable to obtain additional reserves in international markets, convertibility was suspended around mid August, and the Russian Central Bank has no choice but to allow the ruble to float.

All throughout this process, the Russian Government had the ABILITY to pay in rubles. However, due to its choice of fixing the exchange rate at level above ‘market levels’ it was not, in mid August, WILLING to make payments in rubles. In fact, even after floating the ruble, when payment could have been made without losing reserves, the Russian Government, which included the Treasury and Central Bank, continued to be UNWILLING to make payments in rubles when due, both domestically and internationally. It defaulted on ruble payment BY CHOICE, as it always possessed the ABILITY to pay simply by crediting the appropriate accounts with rubles at the Central Bank.

Why Russia made this choice is the subject of much debate. However, there is no debate over the fact that Russia had the ABILITY to meet its notional ruble obligations but was UNWILLING to pay and instead CHOSE to default.

There is a lot of money to be made in the 2013 financial markets by teaching some people a lesson on how money works.

Leave a comment