The German weekly SPIEGEL carries an article this week on the polemical propaganda on part of those that argue against the euro. The article is very interesting for different reasons. Since it is not available online, let me quote some sentences to discuss their implications.

The first thing that is odd is that the article mixes together a very heterogeneous group of people. Dirk “Mister Dax” Müller, who has been writing about the German stock market extensively and witched to the euro, Heiner Flassbeck, who is a respected economist and formerly worked at UNDP, Bernd Lucke, one of the leaders of the paleoliberal party Alternative für Deutschland, and Hans-Olaf Henkel, former head of the BDI (“the voice of German industry”). So, Falssbeck and Lucke are German economists, Müller and Henkel are not. Müller is a professional author and Henkel was the major lobbyist for German industry. I would have expected that the SPIEGEL journalists would at least try to summarize why those people think that the euro should be abandoned and by whom. It doesn’t happen.

What happens instead is that the SPIEGEL points out that in the last two years there were seven titles of the magazine which carried a warning of the euro being soft (inflation!) or close to destruction (and before that: inflation!). This is followed by the sentence: “But until now the euro stayed solid”. What is the take away message of that? Different ideas come to my mind: the SPIEGEL admits that it was wrong. Or it thinks that its warnings were correct, but because of the awareness it created the euro did not go down. Or, it did not happen just yet. The SPIEGEL does not pick up on this.

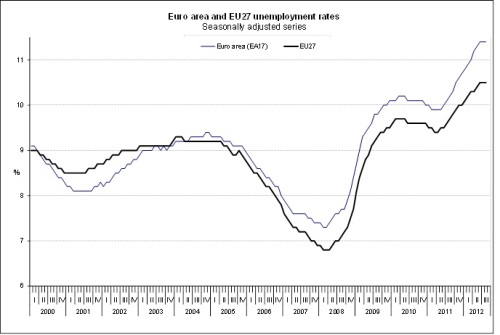

The SPIEGEL does also not mention that there is a problem in the first place. So, before hearing from those that are against the euro, one would suspect that the readers are introduced to the euro zone’s problems. One, maybe two paragraphs could have shown something like this (could not find a more recent graph – current Euro area unemployment stands at 12.1% as of March this year):

Then, on page 51 at the very end of the page, finally some words about economics. Without the euro devaluations of their national currencies would help the countries in crisis to regain competitiveness. However, that would destroy the German export economy which would cause unemployment in Germany to rise. These two sentences are presented as facts. They are both incorrect. Let me explain why.

Prices are set in markets by firms. Depending on the exchange rate, firms set a price and make a profit P. Now if the currency of the exporting country appreciates (like Germany’s would after the euro break up) then IF PRICES ARE NOT CHANGED after reintroducing the nominal exchange rate the exporting firms sees its profits falling measured in euros (or deutschmarks). However, that is very unlikely to happen. First of all, a euro exit would create a problem for firms. They have to print their prices in the new currency. They might just use the nominal exchange rate to translate their price, but why should they?

From the perspective of a firm that is located in the periphery a reintroduction of the national currency means that the foreign competitors would make lose market share if they leave their prices unchanged. If 1 euro buys 2 pesetas and the widget cost 1 euro before, putting a price tag of 2 pesetas would allow domestic firms to out-compete them. Since their costs are in local currency, these were 0.50 euros before and now are 0.50 pesetas. So, even with a price of one euro Spanish firms would be profitable whereas the German firm would not. What does the German firm do?

The German firm was more competitive than the Spanish firms before the euro collapsed, so their costs were only 0.30 euros per widget. If the German firm would try to keep market share it would lower its price down to where it makes no profit at all but stays in the market. This price is equal to costs, which is 0.30 euros or now 0.60 pesetas. Going that low is not necessary, as Spanish firms left their prices unchanged at one peseta. So, the German firm might play along and sell for a price of 1 peseta and make a profit of 0.40 pesetas or 0.20 euros. Before, its profit was 0.70 euros per widget.

At this point two things should become very clear. One: the SPIEGEL’s jounalists seem to be unable to understand economics, otherwise they would have put more economics into the article. Also, the two sentences which they put as fact are wrong in the sense that they are based on an assumption which in reality is not fulfilled. Nominal exchange rate changes will not translate old prices directly into new prices. This topic is discussed under the heading of exchange rate pass through in economic theory. The New York Fed has a paper online by Kampa and Goldberg which says in the abstract:

We provide cross-country and time series evidence on the extent of exchange rate pass through into the import prices of twenty-three OECD countries. Across the OECD and especially within manufacturing industries, we find compelling evidence of partial pass-through in the short-run – rejecting both producer currency pricing and local currency pricing as characterizations of aggregate behavior.

The idea of partial pass-through is that firms set their prices neither by fixing their price in the currency of the producer nor in that of the local market but somewhere in between.

The second point is that the SPIEGEL seems to think that it’s idea is not to inform the readers, but to show what opinion leaders think. So, there is no truth to be fund and therefore for reality it does not matter what’s wrong with the euro. What matters is what the opinion leaders say and how they create and forge new alliances. This becomes clear when the SPIEGEL writes about the Alternative für Deutschland, which is supported by many professor, increasing their credibility, especially for voters without academic education. What is behind this sentence is a disregard for science. Politics is all about credibility, and it does not matter that the professors of economics have a) not seen the crisis coming, b) in the years before the crisis campaigned for higher German exports and less government spending when these afterwards turned out to have been the main causes behind the competitiveness problems that they now try to solve and c) have instead of reforming Europe and the euro to make our societies work opted for expansionary fiscal austerity, an idea so stupid that there is still no theory behind it. All our introduction to macroeconomics textbooks say that in conditions of weak demand less government spending will lead to less income and hence a fall in GDP. All these textbooks say that when monetary policy stops working fiscal policy is the solution.

Oddly enough, Heiner Flassbeck has argued in the same way and only turned into someone proposing a break up of the euro as a second-best solution when 5 years into the crisis that started in 2008 with the sub-prime crisis and 3,5 years into the euro crisis that started with the Greek sovereign debt problems and then with the burst of real estate bubbles in Spain and Ireland there is still no public debate about what happened and what to do about it. Instead, Germans still have the impression that they saved the euro and have to pay for it when Spanish and Irish tax payers pay back loans to German banks which should have been defaulted. At the same time, flight capital has pushed German interest rates down to zero for short-term government bonds, saving the country tens of billions every year.

Without the press smarting up the crisis will be solved by technocrats with a financial sector background. These are the people who have caused the crisis. And so the success story of Europe seems to have ended. We are now on a slippery slope on the road to serfdom, but not, as Hayek originally thought, because the welfare state makes people lazy and dependent but because we have lost the power of democracy to take care of ourselves. This morning I went running in Tiergarten, which is a park west of the Brandenburger Tor. President Obama will hold a speech there this noon. The public has not been invited to see him, and I found my way blocked by police (I did not plan to see him talk). It is a symbol how far politicians and the people have moved apart. In one week, this speech took place 60 years ago to the day:

–we have lost the power of democracy to take care of ourselves–

So it is the implementation of the system which is needed and there is nothing wrong with the democratic system in itlself.

By: Javed Mir on June 19, 2013

at 2:48 pm